In this post, I’ll talk through how I used the $100 hotel benefit on my Citi Premier card. I’ll start with a quick introduction to the card before diving into the specifics of the credit and how I got near-maximum value out of it this year. Read on to learn all about the Citi Premier’s $100 hotel credit!

About the Citi Premier

With the Citi Prestige no longer taking new applications, the Citi Premier is the top-tier credit card in the Citi ThankYou program. This is a bit surprising, as the card has an annual fee of only $95, well below the $550 annual fee of the Chase Sapphire Reserve and the $695 annual fee of the American Express Platinum, the top cards in the other two major rewards programs. Even Capital One has gotten in on the ultra-premium card game, with its $395 Venture X Rewards card.

As of publication, the public signup offer is “Earn 60,000 bonus points after spending $4,000 in purchases with your card within the first 3 months of account opening,” which is a pretty good offer but down from the 80,000 points that were being offered a few months ago.

But what’s most surprising is that for $95, the Citi Premier is a pretty great card. It earns 3X points for spending at restaurants, supermarkets, air travel, and hotels. On top of that, it offers a $100 annual hotel credit, which is what we’re here to talk about today.

About The Citi Premier $100 Annual Hotel Credit

Here’s how Citi describes the annual hotel credit:

Enjoy $100 off a single hotel stay of $500 or more, excluding taxes and fees, through thankyou.com, once per calendar year.

Citi.com

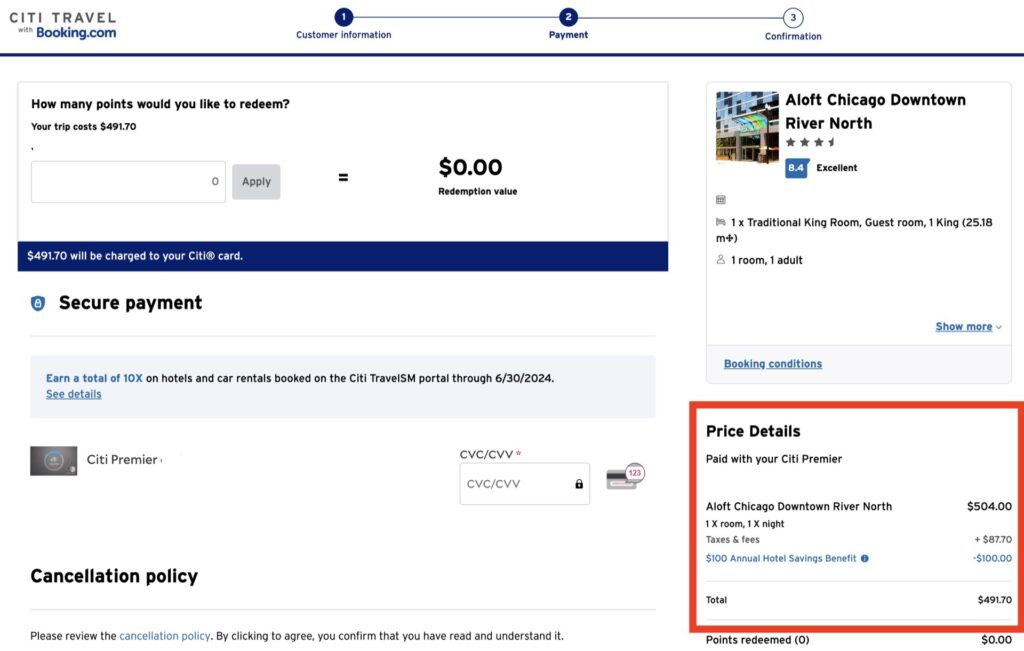

I’ll outline an example booking below, but on a technical front the credit is straightforward. You’ll book through Thankyou.com, ensuring you’re using your Citi Premier account (if you have multiple thankyou.com accounts) throughout. If you do that, the site is very transparent that you’re using the credit. Room rates are before the credit and before taxes and fees, but the later booking screens reflect taxes, fees, and the credit. You have to book with your Citi Premier card.

There’s two important restrictions here. First, the stay has to be for $500 or more. This might seem like no big deal at all, but it’s actually more significant when you combine it with the second restriction—that the booking has to be through thankyou.com.

Any time you’re locked into a specific booking method, you run the risk of missing out on the best price. Thankyou.com might not have the best price as Expedia.com which might not have the best price as booking at the hotel directly and so on. This gets more complicated when you factor in things like cancellation policies or complimentary breakfast for certain booking methods.

These days, Thankyou.com works with Booking.com for their prices, so you might expect similar prices, though there’s no guarantee of that (and this post has a relevant example of differing prices).

This is why the $500 requirement winds up being such a big deal. Let’s say you’re able to book right at around $500. If thankyou.com prices are around 10% higher than the best option (say $550 vs. $500), the $100 credit still nets you $50.

But $500 will often mean multiple nights, which will often mean at least 3 or 4 nights, which will bring you booking into the $1000+ range. At that point, if thankyou.com prices are 10% higher, say $1100 vs. $100, the $100 credit is worthless.

To that end, you’re going to have the best luck on stays that cost as close to the $500 requirement as possible. Fortunately, I had exactly such a stay planned this year.

Using the Citi Premier $100 Hotel Credit

I happen to have cause for a one-night stay in Chicago, and hotel availability is tight. I’d previously booked a refundable night at a downtown hotel for around $600, but had flagged this as a possible opportunity to get good use out of this credit.

Booking Via ThankYou.com

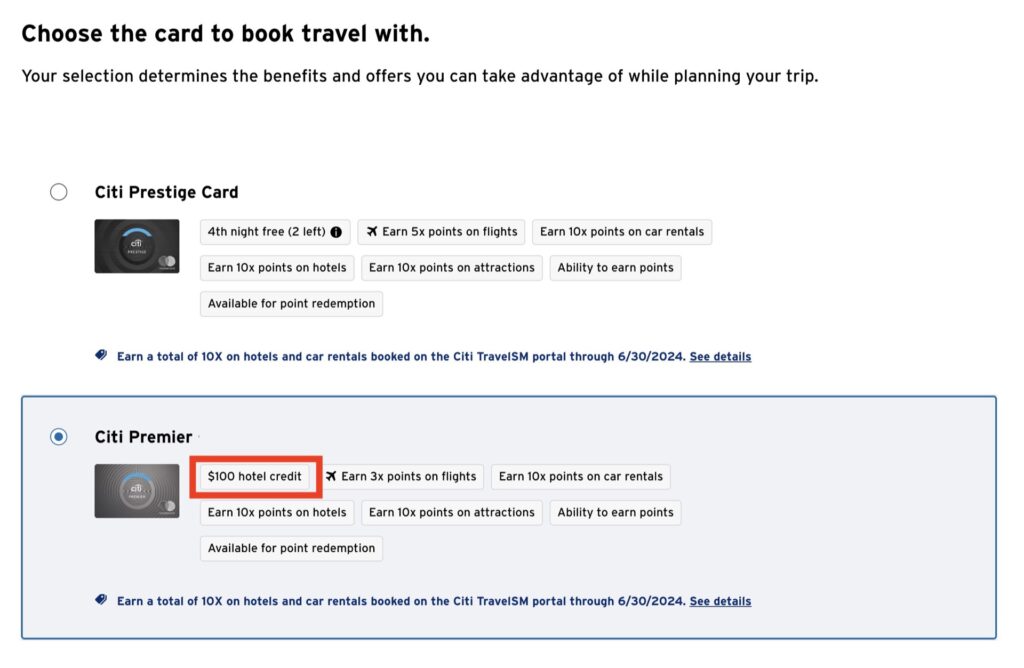

I logged into thankyou.com. Well, I tried, and it bounced me to citi.com, where I had to navigate my way to access the ThankYou Rewards program, at which point I had to authenticate my account again. Eventually I got through and it asked me which card I wanted to use, as I still have a Citi Prestige.

You can see this screen reflects the $100 credit perk:

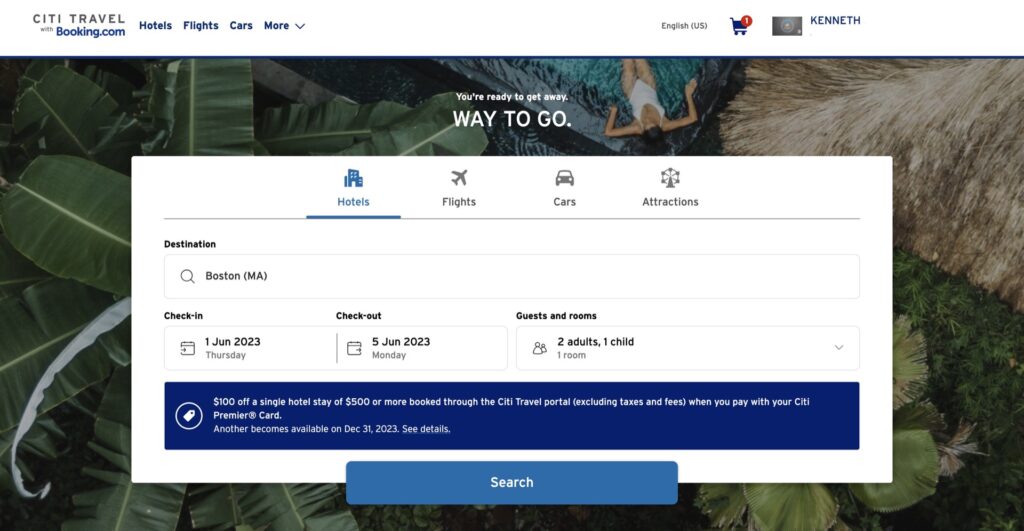

Eventually I got to the search screen. I forgot to screenshot it, unfortunately. It looks almost exactly like the shot below, except this is after I used the credit, so the fine print reflects that I’ll have a new credit available at the end of the year. Before you use the credit, the fine print should reflect that you have a credit currently available:

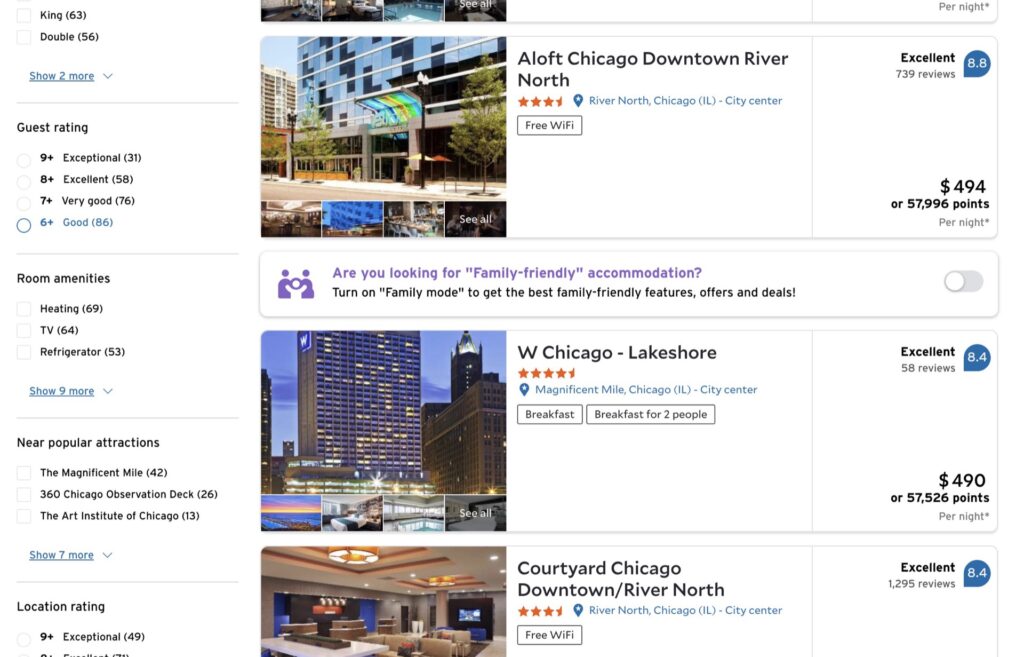

While hotel availability is limited on the night in question, I was able to find a few decent options right around $500. One option was the Aloft Chicago Downtown River North, which I’ve stayed at for a single night in Chicago before.

Finding a $500 Option

Immediately you’ll notice this option actually comes in at $494 per night. The hotel credit requires $500 before taxes and fees. (FWIW, I had issue getting one rate right at $500 to work, too. Could have been some technical rounding error, or maybe just some other glitch.) But I had a hunch I’d easily be able to get this rate up to $500.

Indeed, clicking in to see the hotel options immediately revealed that I could spend $10 more ($504 before taxes and fees) for a refundable rate. I’m happy to have a refundable rate for this stay, and there just aren’t going to be many other opportunities for me to get full value out of this credit.

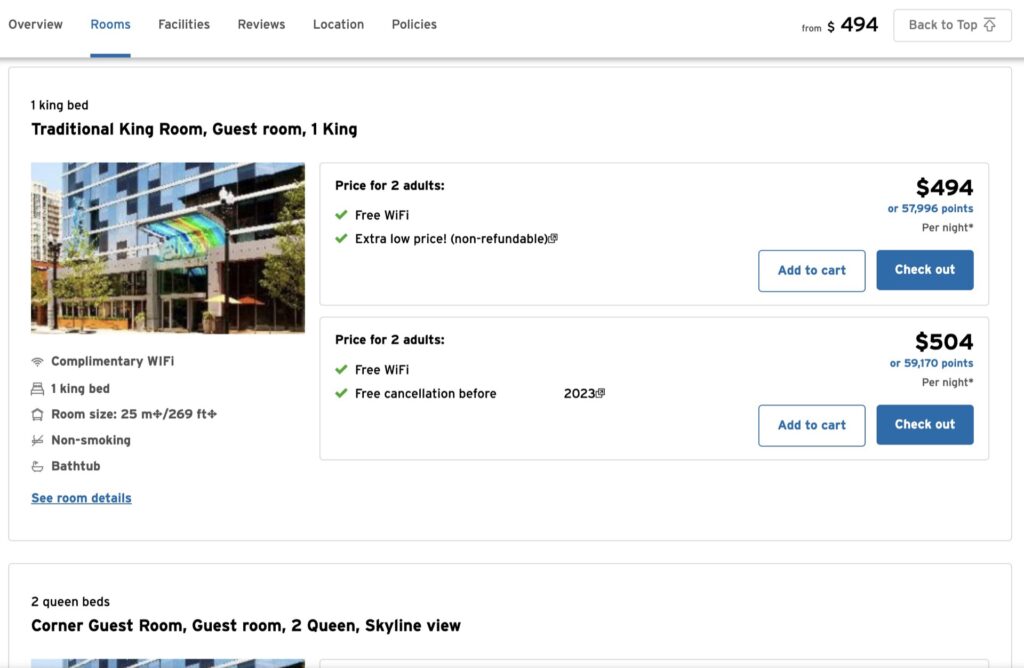

When you get to checkout, you’ll clearly see the final price, with taxes, fees, and the credit, reflected:

How much value did I get from the $100 credit?

I paid $491.70, saving $100 off the ThankYou.com price of $591.70. Of course, the analysis doesn’t end there. Sure, it says right there I’m getting $100 of value, but how much value am I really getting?

Well, there’s two answers. The best two prices I found for this room, after taxes and fees, were $585.83 for the refundable option and $579.96 for the non-refundable option. This means the credit was worth somewhere between $88.26 and $94.13. That’s pretty good value for having to book through a certain method, and it nearly offsets the $95 annual fee for the card.

How good is the Citi Premier $100 hotel credit benefit?

Overall I’m happy with my experience using the credit this year, and I’m cautiously optimistic going forward.

The challenge is finding a stay where spending as close to $500 as possible makes sense. This means most single hotel nights won’t work, because you’ll usually have cheaper options. I was “lucky” that wasn’t the case for this stay.

We don’t do many multi-night stays in the range of $100 to $250 per night, but even with three or four of those a year, chances are good we’ll be able to find a good way to use this credit. (If we’re on the higher end of our budget, we’re probably in Amex Fine Hotels + Resorts territory.)

I don’t like to let a credit go unused, but I’ll be very careful not to force this one. It’s easy to try and squeeze value out of credit cards just to wind up spending more than you otherwise would have. This credit is designed to get you booking via the ThankYou.com portal, and that won’t always be the best option.

To that end, it bears pointing out I don’t consider this credit a direct “offset” of the $95 annual fee. The Premier is worth $95 to me each year for other reasons (that I’m not going into here). I don’t expect this credit to justify the annual fee every year, but I’m happy it did that this year.