In this post, I’m going to go through my recent experience with World Nomads Travel Insurance. We’ve been regular buyers from World Nomads for years now, but I finally got to actually test the claims / recover process (yay?). I’ll start below with some basics of travel insurance and World Nomads before talking through this claim about my lost laptop. Read on to learn all about my experience with World Nomads travel insurance!

What is travel insurance?

Travel insurance is insurance you purchase to protect you against bad things happening while you travel. Generally, you’ll be looking for policies that reimburse you in case of:

- Trip cancellations / delays / changes

- Anything bad that happens to your stuff (it gets lost or stolen)

- Unexpected emergency medical expenses

For that third point, it’s important to understand travel insurance is not as comprehensive as primary health care insurance. That is to say it should not be seen as a replacement to your primary insurance, but more of a supplement to it.

Further on the medical point, it’s worth noting that travel insurance might not always cover medical evacuation to the extent you want. A common restriction is that travel insurance will cover getting you to a home hospital if it’s necessary. We purchased a separate MedJet Membership that would get us to a home hospital if we prefer.

What is World Nomads?

World Nomads is one of the most popular companies to purchase travel insurance from. The insurance industry remains wildly complicated, so there were a number of other companies whose names were on these documents—TripMate, Nationwide, Generali Global Assistance—but we purchased through World Nomads and that’s where almost all our communication related to our claim occurred.

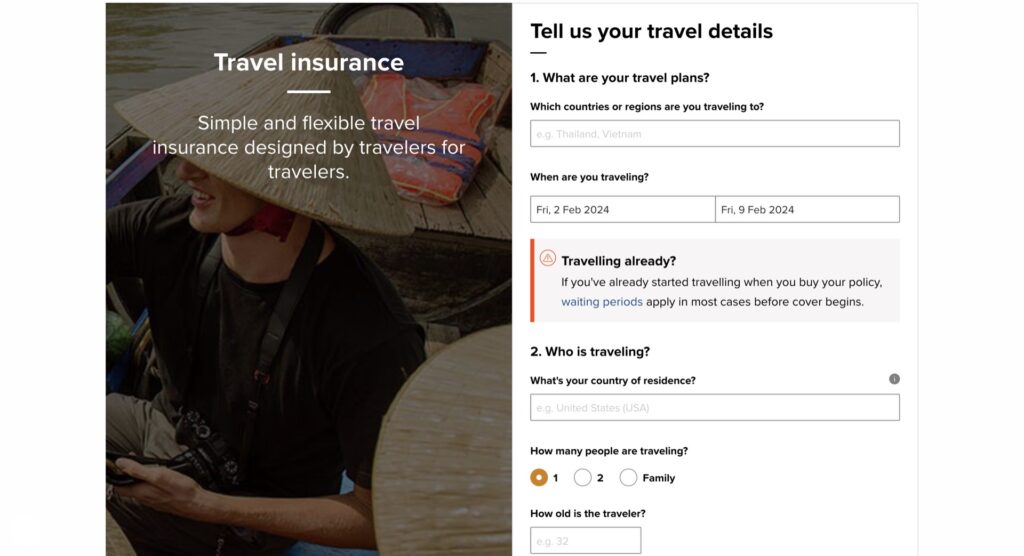

Buying travel insurance from World Nomads is straightforward, and we’ve done it for several trips. On the World Nomads USA homepage you can start by submitting your trip information:

Typically, you’ll see two levels of coverage to choose from: Standard and Explorer. For example, we’ve got an upcoming monthlong trip to Italy, and the price for those coverage options comes to $371 for Standard and $683 for Explorer. You’ll have to compare specific coverage and pricing for your trip.

Our Travel Insurance Policy for This Trip

For our Dubai / India / Doha trip we opted for the more expensive coverage, the Explorer Plan, which came to $639.21. Generally, the farther, more expensive, and more uncertain (i.e. in terms of what we know about the place) the trip, the more likely we are to opt for the more expensive policy.

Relevant to this post, the policy had a “Per Article Limit” for personal effects of $1500. This meant that even though my lost laptop was worth more than $1500, I’d only be able to recover that much (spoiler: the additional $236 was interest).

Since the policy cost $639, I’d at most be “netting” only $861, but that’s still better than $0. At least the travel insurance “paid for itself”, though insurance is one of those things that you actually hope is a waste.

How I Lost My Laptop Aboard Air India

As part of our amazing journey to Dubai, India, and Doha, I managed to leave my MacBook Pro on the plane from Dubai to India. (You can read our Review of Air India Business Class here.)

This was particularly frustrating because it was the only laptop we had with us (i.e. no way to get work done now). Happily, though, the MacBook Pro was secured enough that it’s just a brick in anyone else’s hands, and after a broken laptop incident years earlier we keep everything backed up.

The best source of the description of my specific incident is actually the “Event Description” I submitted as part of my claim.

Event Description:

I boarded Air India 930 from DXB to DEL on February 27, 2023 around 9:15AM (DXB time). I was sitting in seat 2J with my child in seat 2H. I took out my laptop (the lost item) and put it in the storage between the two seats. I didn’t use it the rest of the flight.

After deplaning at DEL around 14:33, we went through immigration and retrieved our checked bags. We then met our driver and an “airport representative” from our hotel.

Around 16:45 we were en route between the airport and our hotel when I recalled taking the laptop out of my backpack but not replacing it. I asked the driver to pull over and I confirmed the laptop was not in my backpack.

I called Air India customer service at this point, and their business class representative told me over the phone to report it to the airport.

I also contacted the hotel’s airport representative via WhatsApp. A few hours later, he reported back that he “checked with Air India, nothing they have found in the aircraft. Reference Ajay (Air India Staff).”

I filed a report with GMR, the entity responsible for lost items at DEL online on February 28, and I’ve attached the screenshots of this report as separate items in the event description.

I contacted both Air India and GMR repeatedly by email, beginning February 27. Neither has been able to find the item, and both claim the other is responsible. I’ve attached these email exchanges as a separate item in the event description.

My Claim Event Description

Of course I don’t claim to be blameless here. The truth is that I was foolish to think I’d get work done sitting next to my toddler, so I probably didn’t need to take my laptop out anyways. It never got any use because I was busy entertaining Zoe the whole time.

My Efforts to Get My Laptop Back

The above Event Description explains the initial and longterm steps I took. I was grateful to the staff at The Oberoi – New Delhi, who did try to bridge the gap between me and the airport / airline, even if it was for naught. I think the most important thing is that I had a twofold goal at this point.

Immediately, I wanted my laptop back. But failing that, I knew I’d need to submit a travel insurance claim. And I knew part of that claim would be showing I did as much as possible to get the laptop back, while everyone else did nothing (and, at some point, presumably just stole it).

I’ll spare you the email chains I had going with both Air India and GMR, but suffice to say my last email on the matter, sent to both GMR and Air India, began:

GMR and Air India reps:

Thank you both for your help up to this point. I’ve put both Air India and GMR Lost and Found in this email because you don’t agree on who is responsible for this matter.

My Email to GMR and Air India

That email went on to quote emails from both sides saying the other is responsible. I received no response.

My Analysis of My Claim

I am a lawyer, but this section isn’t intended as legal advice. I think it’s an interesting point of curiosity the extent to which a lost item is actually covered by travel insurance, and I honestly didn’t know what to expect from my claim.

There were two important sections of the policy:

NOTICE OF LOSS – If Your property covered under the Group Policy is lost,

stolen or damaged, You must:

(a) notify the Company, or its authorized representative as soon as possible;

(b) take immediate steps to protect, save and/or recover the covered property;

(c) give immediate notice to the carrier or bailee who is or may be liable

for the loss or damage;

(d) notify the police or other authority in the case of robbery or theft

within twenty-four (24) hours.

and

BAGGAGE/PERSONAL EFFECTS

The Company will reimburse You, up to the maximum shown on the

Confirmation of Coverage, for loss, theft or damage to baggage and

personal effects, provided the Insured has taken all reasonable measures to protect, save and/or recover his/her property at all times.…

This coverage is secondary to any coverage provided by a Common Carrier

and all other valid and collectible insurance indemnity and shall apply only

when such other benefits are exhausted.

I think there’s a lot of interesting legal analysis that could be done here, and while I won’t go through all my thoughts, I think it’s worth it to talk a little bit about the issue. I think I took the necessary steps by contacting the airline, the airport, and World Nomads.

The big question was whether I took “all reasonable measures to protect, save, and/or recover” my property “at all times.” Leaving a valuable item on a park bench, realizing it two days later, and not even going back to check would probably not be reasonable, in my opinion.

Conversely, leaving an item secured in your hotel room for 30 minutes, realizing it’s missing when you return, and immediately reporting it to all authorities would definitely be reasonable. In short, the “reasonableness” of the situation sort of correlates with how much a lost item looks like a stolen item.

In my case, the laptop was clearly on the “stolen” end of the spectrum. The airline and airport have a protocol for handling lost items. The business class cabin was never open to the public. I told the airline about the lost item before the plane was anywhere near ready to go to its next destination (i.e. no other passenger was in that seat).

Could I have been more responsible? Of course. But that’s true of most any theft. I’ve been robbed at gunpoint before and I still think about the chain of questionable decisions that led me to that point. The bottom line is that between the time I left the laptop and I contacted the airline, no one in the public would have had access to it. (Sidenote: You could argue about the other people deplaning. But if someone takes it in that case, I’d say that’s just plainly theft as well.)

Submitting My Claim

First, I contacted World Nomads via the website sometime before March 3 (so within a few days of the loss) to inquire about whether this incident might qualify for coverage.

I knew the response I’d get from a customer service rep (“file a claim if you want”), but the point of this was that the policy required me to “(a) notify the Company, or its authorized representative as soon as possible.” At the point I determined the item to be lost, I did that.

Then, around March 20, I submitted my claim. Along with the event description, I attached: a receipt for the laptop, a credit card statement evidencing the purchase of the flights, a printout of all the emails, and screenshots of my “lost item” submission via the airport website.

On or around April 18, World Nomads (or Nationwide) requested more documentation: my AppleCare+ contract (to show AppleCare+ didn’t cover it), boarding passes / tickets from the flight. I provided this information…and then heard nothing for a while.

A Happy Surprise 9 Months Later

I guess travel insurance claims take as lost to gestate as do humans, because 9 months later, in January 2024, I received notice that my claim was being paid to the tune of $1736. That’s $1500 for the maximum coverage (after depreciation of the laptop was accounted for, it was still over $1500), plus $236 in interest for the time the claim took to process.

Truth be told I’d just assumed the claim was dead. Maybe it had been denied and gone to my spam folder. Maybe it was lost on someone’s desk. Of course it might have been responsible to followup on it, but part of me just wanted to move on from the issue.

So it was a great surprise to finally receive word that the claim was approved. I don’t love how long it took, but the $236 in interest seems sufficient compensation for that.

Will We Use World Nomads Again?

Before hearing back about my claim, I was planning to shop around for travel insurance on my next trip. But seeing as this claim eventually got resolved, in my favor, I’m planning to use World Nomads again. If the claim had been quickly denied, I’d probably feel the same. If it had been denied with a 9-month delay, I’d probably plan to shop around.

As I mentioned earlier, you sort of hope travel insurance is a waste. And various credit cards offer various levels of protection for trips. Depending on what cards you use and what kind of trip you’re taking, you might not need additional coverage. But what I’m most buying the insurance for is catastrophic events that these policies cover and credit cards don’t.

To that end, getting reimbursed for my laptop is a nice way to break even (at least over the cost of a policy for about two trips) on my travel insurance expenses. Hopefully I never need to use it for anything big, but it’s nice that it will sometimes pay for itself on the little things.